Just recorded a pod on a paper discussing different notions of ‘risk’.

Paul Slovic discusses risk as analysis vs risk as feelings (affect/emotion).

It reminded me of these constructs of risk vs uncertainty based on Knights work – discussed by Gigerenzer and colleagues in the two attached extracts.

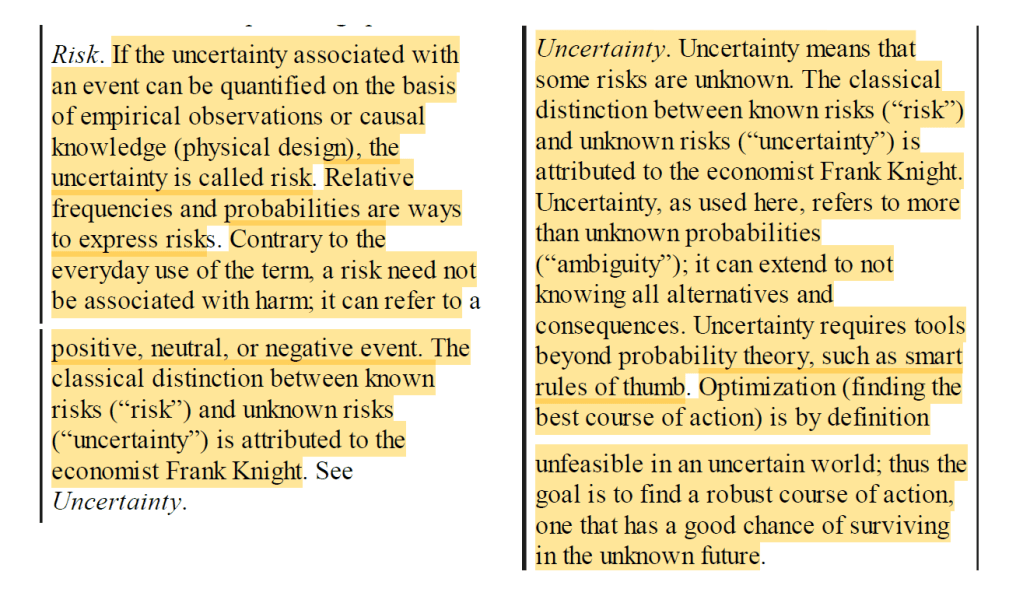

Simply, for Knight, ‘risk’ is represented by known, or theoretically knowable, probabilities, empirical observations, causal knowledge and more.

In contrast, uncertainty is represented by non-quantified, unknown, or unknowable knowledge/data.

Or as explained by Gigerenzer, ‘known risks’ = risk (or, at least, knowable), and ‘unknown risks’ = uncertainty (or, unknowable).

Terje Aven expands these ideas, arguing that there are many different definitions, but advances one where risk can incorporate events, consequences, probabilities and also the strength of knowledge of risks, uncertainty intervals, and consideration of surprises.

This may also include risk as feelings, like dread. Indeed, for Aven, risk includes objective, subjective and intersubjective elements.

P.S. Besides the pod, I also have an upcoming summary discussing myths of risk from Hansson.

Shout me a coffee (one-off or monthly recurring)

Refs:

Image 1: Gigerenzer, G. (2015). Risk savvy: How to make good decisions. Penguin.

Image 2: Neth, H., Meder, B., Kothiyal, A., & Gigerenzer, G. (2014). Homo heuristicus in the financial world: From risk management to managing uncertainty. Journal of Risk Management in Financial Institutions, 7(2), 134-144.